My guest is Sébastien Gouspillou, he is the Co-Founder and CEO of BigBlock Datacenter a Bitcoin mining company based in France. BigBlock Datacenter is running several mining farms in Russia, Central Asia, and Africa. His mission is to qualify France in the world competition of proof-of-work. We are going deep into the business and the ecological effects of Bitcoin mining.

“Since bitcoin responds to a major need and is there to last, it seems more relevant to take advantage of this new electrical demand than to be afraid with catastrophic studies or to wait for a miracle protocol supposed to replace the proven principle of proof of work.” – Sébastien Gouspillou

“Each country with big not carbonated electricity resources will mine and have an economical advantage over other countries.” – Sébastien Gouspillou

Topics:

- How Sébastien Gouspillou became a Bitcoin miner

- Addressing climate change

- Debunking myths around Bitcoin mining

- Myth 1: One transaction produces X CO2

- Myth 2: Bitcoin is an ecological disaster

- Myth 3: Bitcoin is mined mainly with coal in China

- Myth 4: Bitcoin is not useful

- Mining in the Virunga National Park, Kongo

- Mining in Kazakhstan

- Bitcoin hash rate follows the price

Abstract / Transcript

There are some climate change deniers in the Bitcoin space. What is your opinion on climate change?

Climate change is indisputable, we can already clearly see its effects in certain countries where we work. In Tajikistan, Kazakhstan or Russia. In Tajikistan, the whole ecosystem is disrupted, many storms are following one another. In Kazakhstan, temperatures are rising twice as fast as in the rest of the world. We have very high temperatures during the longer and longer summer. In Siberia, we had several hot months in 2020. Those Bitcoin guys who deny climate change seem to have never visited these countries.

How did you find out about Bitcoin? When did you hear about it first?

My associate, Jen François, who is a geek and also my oldest friend, told me about it in 2010 or 2011, at the very beginning. He has tried unsuccessfully to get my attention to the subject for years. I really started to realize what bitcoin was in 2015. In 2016 we installed the first rigs.

What attracted you to work in the Bitcoin space?

I had the chance to visit mining farms in Asia at the end of 2015, it really impressed me, and I knew that was what I wanted to do …

What is the most interesting property or characteristic of Bitcoin in your opinion, that sets it apart from all other monies or payment systems?

It’s just the best monetary system mankind could dream of. We are very close to a perfect currency, we touch the ideal of many monetarists Milton Friedman, Friedrich Hayek, or Maurice Allais, not only from the Austrian school of economics.

You were invited to speak in front of the Cryptocurrencies Information Commission of the French national assembly on 22 May 2018 to speak about the importance of cryptocurrencies and especially of mining in France. You were there to discuss these very common myths or false assumptions about mining

Myth #1: A single bitcoin transaction produces X amount of CO2?

This tale of consumption per transaction is irrelevant. We agree that the great performance of the Bitcoin blockchain is the immutability of its data. Bitcoin is consuming energy to enable exactly this functionality. Bitcoin mining secures the blockchain, independently from the number of transactions. Bitcoin is not only a payment system.

If I pay you with a gold coin, a Louis, for example, it’s a peer to peer transaction, no middleman. The transaction itself does not directly spend energy. But there is a lot of energy spent in extracting, transporting, storing and securing gold stocks in banks and central banks. If we include it in the calculation, this payment with a louis d’or will have cost more than the consumption of electricity for an American family for 6 months. I can do the same reasoning with the Visa credit card: if I pay you in EURO with my Visa card, it is not only the energy requested by Visa that is taken into account to calculate the energy expenditure of this transaction, but the whole Euro monetary system. That is to say the salaries of central bankers and private bank bosses, their cost of printing money by credit, with all the energy spent to repay this loan and its interest. The environmental cost of this monetary system is obviously not proportional to the number of Visa transactions. It’s the same for bitcoin and I can prove it: during large transaction peaks on the Bitcoin network, there is not more consumption than the day before or the next day. To talk about energy cost per transaction on bitcoin, is not relevant.

Myth #2 Bitcoin power consumption is an ecological disaster

For people who do not see the how Bitcoin makes sense, it is totally useless and therefore, they say it consumes too much. But it doesn’t make it an ecological disaster. Who ever said Christmas lights were an ecological disaster? Electronic devices on standby consume more than bitcoin, they are useless, it’s pure waste, we know, we take offense, but who qualifies it as an ecological disaster? Searching a little, I find tons of examples of unnecessary activity for me consuming as much or more than bitcoin. So, no, disaster, I refute, obviously. But the important thing is not so much how much energy consumed, but which energy is consumed? Today, Bitcoin farms are where there is excess capacity to generate electricity; this production may or may not be carbonated. But tomorrow, bitcoin mining will be done mostly from clean sources, that’s for sure, because renewable energy producers can sell their surplus at a very low price, because it’s just a surplus. Hydrocarbon power plants can have the capacity to produce more, but they have no surplus, unlike renewable energies. If they want to sell energy to miners, they have to produce it and buy coal to do so. But renewables have a decisive competitive advantage, they do not have to pay for their raw material. The price of hydrocarbons is increasing, the only miners who will use them in the long term will be the countries producing coal and oil.

Myth #3 Bitcoin is mined mainly with coal in China

It’s a tale: China is the biggest mining country, yes; China’s energy mix is 65% carbon, yes. But it is not on coal plants that mining is mainly done, it is on hydroelectric stations. In Sichuan alone, there are more than 500 hydroelectric dams; it is also tens of thousands of small run-of-river power plants. Their surplus would be enough to power 4 additional bitcoin networks. So, no, Bitcoin is not charcoal black.

Myth #4 Bitcoin is not useful, but what about the Petrodollar, the cost of military defense and war?

Bitcoin is not only useful, it is essential: it is already a counter-power against States tempted to do total surveillance of populations by currency (CBDC); it is a way to escape the yoke of dictators (35% of the world population lives under an authoritarian government) and to offer financial services to 40% of the world population that the banking system ignores.

How will mining participate in the transition to green energy transition?

It’s simple; today, all renewable projects are subsidized. Despite these efforts by the States, the profitability of these factories is not obvious, it often takes a long time to find an economic balance. Mining offers another form of subsidy to green producers. With crypto-mining, sustainable productions reduce energy waste. It should be understood that the creation of a sustainable power plant has an environmental costs. But once built, having them run at 100% rather than 50% is neutral …

Today, the bitcoin mining becomes a regulator of the electricity of a country, of a region, it will soon be an optimizer of global production-distribution. Imagine the paradigm shift for “green” electricity producers, when miners tell them: whatever your production, there is now a customer of last resort: at any time be it cold or hot, summer or winter, I will buy from you the part of your production that until then you have not been able to value. Help the renewable energy sector is the way that governments have chosen; Bitcoin mining does exactly the same…

What about the halvings and the reduction of mined coins…Nic Carter thinks that the hashpower will get lower, when no more new bitcoin are left to mine and mining is financed by transaction fees only, and therefore the electricity consumption will fall.

This part of Nic Carter’s speech is not clear to me. In my opinion, the hashrate will continue to rise and will only stabilize when the price of bitcoin is stabilized. But that does not necessarily imply an increase in electricity consumption, the energy improvement of equipment also comes into play.

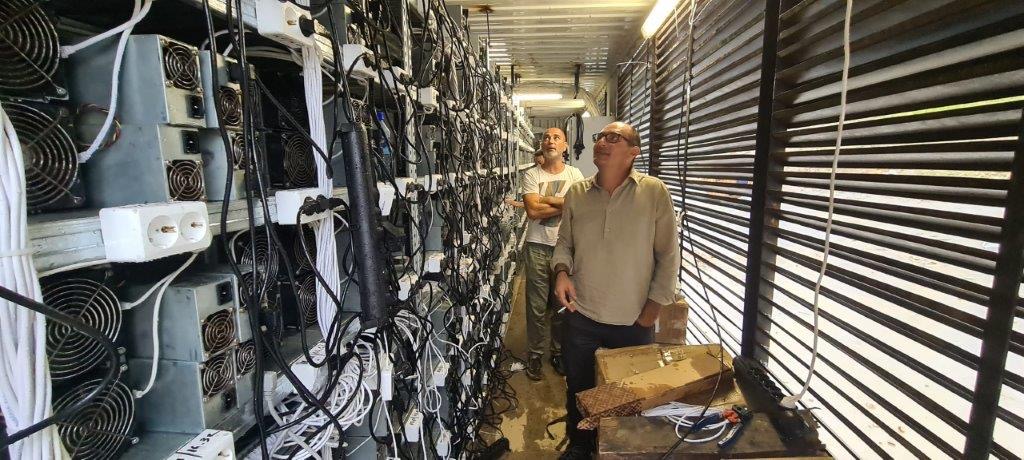

Where are BigBlockDatacenter’s mining facilities?

Russia, Central Asia, Africa

In the Kongo you are mining in Virunga National Park, what is this project about?

Virunga National Park plays an important role in offsetting carbon emissions. The park and plantations in the province are second only to the Amazon in terms of total forest area, according to the W.W.F.

In 2014 a small hydroelectric power plant was built with an investment from the European Union. Another hydroelectric plant — funded largely by Howard Buffett, a son of the billionaire businessman Warren Buffett — began operating 2015 on the southern edge of Virunga.

The battle of the park director is gigantic: 5 million people live around the park; the primary energy is charcoal, the demand for wood is enormous. In fact, poaching in the park is systematic. The only way to curb this deforestation is to offer the people an alternative. Creating power plants to be able to bring electricity to the population is just essential… We are mining there to help this project as long as we are useful. We have this kind of operation in 5 African countries. The only way to provide electricity to people who do not have it is to create new small decentralized networks. These networks can be helped by mining, which subsidizes the power stations, a lot. The farm has been in operation since September 2020.

Is it not too hot in the Kongo to mine?

On the equator, the climate is mild and the temperature, stable, rarely reaches 30 degrees. That is ok. We have more problems when it is too cold. At -20 degrees the mining rigs freeze, when they come to a halt.

Irkutsk (Russia)

On Irkutsk, we work with Baikal Mining, it’s not our farm. We are just lodged.

Kazhakhstan

We arrived in Kazakhstan in 2018, mining was still confidential there. Interestingly, the government now prefers to sell the overcapacity to miners rather than to the Russian state; in fact, huge farms were created in this country in 2019-2020, with the approval of the authorities. We are still present there, but our developments are elsewhere, now.

Why are you mining bitcoin only?

Why does the gold miner not mine for copper? We believe in bitcoin, we mine bitcoin, that’s it.

Can I as a private person participate in mining? Or only companies?

Investing in mining is not recommended for beginners; I see that a lot of people, crypto connoisseurs, don’t understand anything about mining, so imagine the level of understanding among new entrants … beyond this knowledge aspect, anyone can become a customer, individual or company. To mine, you must want to participate in securing the Bitcoin network, to become an active player. If the only goal is to make money, just buy Bitcoin and keep it 5 years.

How are you selling your bitcoin?

By Kraken or other Bitcoin marketplaces.

What is the impact of a halving on miners?

A lot of them need to shut down, because they are not profitable anymore. Same in a bear market.

A often raised question is: is the bitcoin price following the hash rate or hash rate following the price?

The hashrate follows the price; the contrary is absolutely not true, it is a fundamental error from many analysts. The price of Bitcoin is based on supply and demand, that’s all. Mining does not make the price, in any case.

If the price falls and falls, the cost of mining is also falling, because miners need to stay profitable. Hashing difficulty would fall, meaning less electricity is needed to mine.

The geopolitical impact of mining?

Each country with big not carbonated electricity resources will mine and have an economical advantage over other countries.

How did the use and your explorations of bitcoin change your behavior or your perspective of life?

Above all it gave me a lot of hope; Before I got to Bitcoin, I thought a lot about how the world works, about this fast growing economy for decades that was unable to lift the masses out of great poverty, while shamelessly enriching the few privileged. I came to the conclusion that the problem was monetary. From then on, Bitcoin is carrying a lot of hope, it is a promise of a better world.

What do most people overlook, when they talk about bitcoin? What are you missing in the public discourse about it?

People in Europe, in the West in general, forget that they have banks, they have democratic and benevolent governments, this is not the case everywhere around the world, and it also may not last here.

If I were to buy an ad on all social media platforms and you can decide on the short message that we are pushing into the world, what would it say? What do you want people to know?

Do you want to resist? Give yourself the means to leave the system, ask to be paid in Bitcoin.

Sponsors

Support the podcast

Donations

Der Beitrag Sébastien Gouspillou: Bitcoin Mining Funds Green Energy erschien zuerst auf The Anita Posch Show.